Loan Services

Loan is a financial arrangement where a lender provides money to a borrower, who agrees to repay it over time with interest, often used for personal needs, business growth, or buying assets.

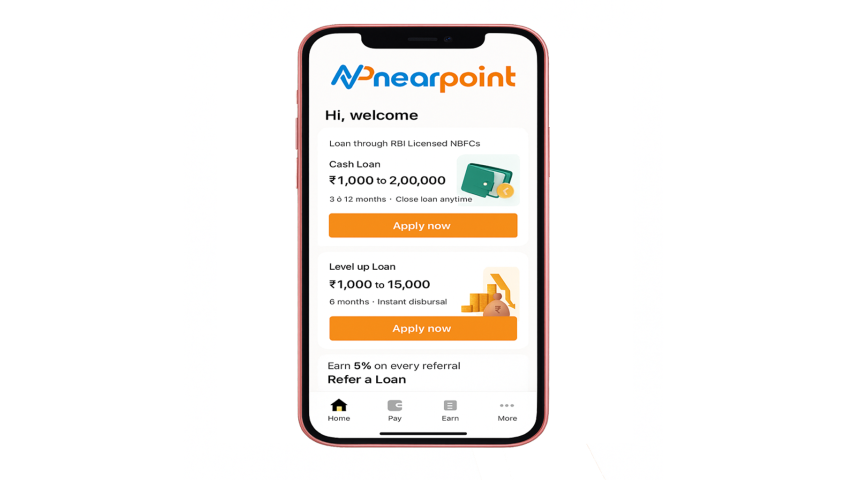

📢 NearPoint Loan Services – Full Details

🏦 NearPoint Loan Facilities

Now through NearPoint Platform, customers can apply for multiple types of loan services easily and securely.

NearPoint aims to provide fast, easy, and trusted loan solutions to individuals, businesses, and salaried people.

📄 Loan Categories Available:

| Loan Type | Description |

|---|---|

| Personal Loan | For personal needs (medical, marriage, travel, etc.) |

| Business Loan | For small businesses, startups, or business expansion |

| Home Loan | For purchasing or constructing new house/property |

| Gold Loan | Loan against gold ornaments |

| Two-Wheeler Loan | For buying a bike/scooter |

| Education Loan | For student's higher education needs |

✅ Loan facility available from top NBFCs, Banks, and Financial Institutions.

✅ Flexible tenure and low-interest rates depending on eligibility.

⚡ Key Features:

- Quick Approval: Instant loan eligibility check and pre-approval

- Minimal Documentation: Basic KYC documents required (Aadhar, PAN, Bank Statement)

- Affordable Interest Rates: Depending on customer's profile and bank offers

- Flexible EMI Options: Choose tenure from 6 months to 60 months

- Safe & Secure Process: 100% digital and secure loan application

- 24x7 Application Facility: Apply anytime through the NearPoint App

📋 Eligibility Criteria:

| Requirement | Details |

|---|---|

| Age | 21 to 58 Years (Varies as per loan type) |

| Income | Minimum ₹10,000/month (for salaried) |

| Documents | Aadhar Card, PAN Card, Salary Slip or Bank Statement |

| CIBIL Score | Minimum 650+ preferred (for bigger loans) |

✅ Even self-employed and small shopkeepers can apply for business loans.

🛠 Loan Application Process (Step-by-Step):

| Step | Action |

|---|---|

| 1 | Open NearPoint App and go to "Loan Services" |

| 2 | Choose the type of loan you want (Personal, Business, etc.) |

| 3 | Fill basic details (Name, Income, Loan Amount, etc.) |

| 4 | Upload KYC Documents (Aadhar, PAN, Bank Statement) |

| 5 | Submit the application |

| 6 | Bank/NBFC will verify and approve the loan |

| 7 | Loan amount is credited directly to customer's bank account |

✅ Full status tracking available inside the app.

🔥 Benefits for Retailers (if you are a NearPoint Partner):

- Earn commission on every loan referral approved

- No heavy investment needed

- Full online tracking system

- Work as Loan Referral Partner (LAP) easily

- Grow your business along with Recharge and AEPS services